Credit Counseling Budget Planning: Build Better Habits

Ever feel like you're running in place financially, no matter how hard you try? Like you're constantly juggling bills, and just barely making it to the next payday? You're not alone. Many of us struggle to get a handle on our finances, and sometimes it feels impossible to break free from the cycle.

It's frustrating to watch your hard-earned money disappear each month without a clear understanding of where it's going. The weight of debt can feel overwhelming, and the idea of saving for the future might seem like a distant dream. Juggling financial responsibilities, especially with unexpected expenses popping up, adds stress to our already busy lives, and it can be difficult to find reliable guidance and support.

This blog post aims to help you understand the importance of credit counseling and budget planning and how they can work together to help you build better financial habits. We'll explore the benefits of seeking professional guidance and provide practical tips for creating a budget that aligns with your goals. Our intention is to offer a roadmap towards financial stability and peace of mind, empowering you to take control of your money and build a brighter future.

In this article, we've explored how credit counseling and budget planning can be your allies in achieving financial wellness. We looked at the role of credit counseling in understanding and managing debt, the importance of creating a realistic budget, and the practical steps you can take to build better financial habits. We also touched on the historical context of credit counseling, debunked common myths, and revealed hidden secrets to success. Ultimately, we want to encourage you to seek professional help and take control of your financial future through informed decision-making and consistent effort.

Understanding Credit Counseling

Credit counseling aims to provide individuals and families with the knowledge and tools they need to manage their finances effectively, reduce debt, and improve their credit scores. This can be especially helpful if you're feeling overwhelmed by debt or struggling to make ends meet. Credit counselors can offer personalized advice, create debt management plans, and educate you on budgeting, saving, and responsible credit use.

I remember a time when I was buried under a mountain of credit card debt. Each month, I felt like I was just treading water, making minimum payments that barely put a dent in the balance. I was constantly stressed about money and felt like I would never escape the cycle of debt. Finally, I decided to seek help from a credit counselor. The counselor helped me understand my spending habits, create a realistic budget, and negotiate lower interest rates with my creditors. It wasn't a quick fix, but with their guidance, I was able to develop a debt management plan that worked for me. Over time, I paid off my debt and improved my credit score. It was a challenging journey, but the support and education I received from the credit counselor were invaluable. Credit counseling empowers individuals to take control of their financial lives by offering tailored advice, developing effective debt management strategies, and educating them on sound financial practices. It's not just about getting out of debt; it's about building a solid foundation for long-term financial security.

The Power of Budget Planning

Budget planning is the process of creating a detailed plan that outlines how you will spend your money over a specific period, usually a month. It involves tracking your income and expenses, setting financial goals, and making informed decisions about how to allocate your resources. A well-designed budget can help you identify areas where you can cut back on spending, save more money, and achieve your financial goals, such as paying off debt, buying a home, or saving for retirement.

Budget planning is like having a roadmap for your money. It allows you to see where your money is going and helps you make conscious choices about how to spend it. A budget isn't about restricting yourself; it's about prioritizing your spending and ensuring that your money is aligned with your values and goals. By tracking your income and expenses, you can identify areas where you're overspending and find opportunities to save. A budget also helps you stay on track with your financial goals, whether it's paying off debt, saving for a down payment, or investing for retirement. It provides a clear picture of your financial situation, empowering you to make informed decisions and take control of your money. Effective budget planning involves setting realistic goals, tracking your spending diligently, and making adjustments as needed. It's a dynamic process that requires ongoing attention and commitment. However, the rewards are well worth the effort, as it can lead to increased financial stability, reduced stress, and a greater sense of control over your financial future.

History and Myths of Credit Counseling

The history of credit counseling dates back to the early 20th century when non-profit organizations began offering financial assistance to families struggling with debt. Over the years, credit counseling has evolved into a more comprehensive service that includes debt management plans, financial education, and credit report reviews. However, there are also several myths surrounding credit counseling, such as the belief that it will ruin your credit score or that it's only for people with severe debt problems. In reality, credit counseling can be a valuable resource for anyone who wants to improve their financial literacy and manage their money more effectively.

The history of credit counseling is intertwined with the rise of consumer credit and the increasing complexity of financial products. As more people gained access to credit cards and loans, the need for financial guidance and support grew. Credit counseling agencies emerged to fill this gap, providing education and assistance to individuals and families struggling with debt. However, the industry has also faced scrutiny and criticism, with some for-profit companies engaging in unethical practices. It's essential to choose a reputable, non-profit credit counseling agency that is accredited by a trusted organization. One of the most common myths about credit counseling is that it will negatively impact your credit score. While enrolling in a debt management plan may temporarily lower your score, the long-term benefits of reducing debt and improving your credit habits far outweigh the short-term drawbacks. Another myth is that credit counseling is only for people with unmanageable debt. In reality, it can be beneficial for anyone who wants to gain a better understanding of their finances and make informed decisions about their money. By debunking these myths and understanding the historical context of credit counseling, you can make an informed decision about whether it's the right option for you.

Hidden Secrets to Successful Budgeting

One of the hidden secrets to successful budgeting is to make it a fun and engaging process. Instead of viewing budgeting as a restrictive chore, try to approach it as a creative exercise that empowers you to achieve your financial goals. Another secret is to automate your savings and bill payments to ensure that you're consistently saving money and paying your bills on time. Finally, don't be afraid to seek help from a financial advisor or credit counselor if you're struggling to create a budget that works for you.

Successful budgeting isn't just about crunching numbers; it's about understanding your values and aligning your spending with your priorities. One hidden secret is to create a budget that reflects your personal goals and aspirations. Instead of focusing solely on cutting expenses, identify areas where you're willing to spend more money because they bring you joy and fulfillment. This could be anything from travel and hobbies to dining out and entertainment. By incorporating your passions into your budget, you're more likely to stick to it in the long run. Another secret is to track your spending meticulously, even the small expenses that seem insignificant. These small expenses can add up over time and derail your budget. Use a budgeting app or spreadsheet to track your income and expenses and identify areas where you can cut back. Finally, don't be afraid to experiment with different budgeting methods to find one that works best for you. Some people prefer the 50/30/20 rule, while others prefer the envelope system. The key is to find a method that you can stick to consistently and that helps you achieve your financial goals. Successful budgeting is a journey, not a destination. It requires ongoing effort and adjustment, but the rewards are well worth the effort.

Recommendations for Credit Counseling

When choosing a credit counseling agency, it's important to look for one that is accredited by a reputable organization, such as the National Foundation for Credit Counseling (NFCC). You should also check the agency's track record and read reviews from other clients to ensure that they have a good reputation. Additionally, be sure to ask about the agency's fees and services before signing up for a debt management plan.

My primary recommendation for credit counseling is to seek help sooner rather than later. Don't wait until you're overwhelmed with debt and facing foreclosure or bankruptcy. The earlier you seek help, the more options you'll have and the easier it will be to get your finances back on track. Another recommendation is to be honest and transparent with your credit counselor. Share all the details of your financial situation, including your income, expenses, debts, and assets. The more information you provide, the better equipped your counselor will be to help you develop a plan that works for you. Finally, be prepared to commit to the process and follow your counselor's advice. Credit counseling is not a quick fix; it requires ongoing effort and commitment. However, if you're willing to put in the work, you can achieve your financial goals and build a brighter future. Look for agencies that offer comprehensive financial education and counseling services. The best agencies will not only help you manage your debt but also teach you how to budget, save, and use credit responsibly. This will empower you to make informed financial decisions in the future and avoid getting into debt again.

Building Better Financial Habits

Building better financial habits is a gradual process that requires consistent effort and commitment. Start by setting small, achievable goals, such as saving $50 per month or paying off one credit card. Then, track your progress and celebrate your successes along the way. As you build momentum, you can set more ambitious goals and continue to improve your financial habits over time. This might involve automating your savings, creating a budget, or seeking professional guidance from a financial advisor or credit counselor.

Building better financial habits starts with awareness. Take the time to understand your spending patterns and identify areas where you can make improvements. This might involve tracking your expenses for a month or two to get a clear picture of where your money is going. Once you have a better understanding of your spending, you can start setting financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of setting a goal to "save more money," set a goal to "save $100 per month for a down payment on a car." Next, create a budget that aligns with your financial goals. A budget is a plan for how you will spend your money each month. It should include all of your income and expenses, and it should allocate money towards your savings goals. Finally, be consistent with your efforts. Building better financial habits takes time and effort. Don't get discouraged if you slip up or make mistakes. Just keep learning and growing, and you will eventually reach your financial goals. Financial habits, like any other habits, are built through repetition and reinforcement. The more you practice good financial habits, the more ingrained they will become. Over time, these habits will become second nature, and you'll find yourself making smarter financial decisions without even thinking about it.

Tips for Credit Counseling

One of the most important tips for credit counseling is to be honest with your counselor about your financial situation. The more information you provide, the better they can help you develop a plan that works for you. Another tip is to be proactive in your debt management plan. Make your payments on time, and communicate with your counselor if you're having trouble keeping up with your payments. Finally, be patient and persistent. It takes time to get out of debt, but with hard work and dedication, you can achieve your financial goals.

Before diving into credit counseling, arm yourself with information. Gather all your financial documents, including credit reports, bank statements, and bills. The more prepared you are, the more productive your initial consultation will be. Also, understand your rights as a consumer. Credit counseling agencies are required to provide you with clear and accurate information about their services, fees, and debt management plans. Don't be afraid to ask questions and seek clarification if anything is unclear. During credit counseling, be open to making changes to your spending habits. Credit counselors may recommend cutting back on non-essential expenses, consolidating your debt, or negotiating lower interest rates with your creditors. Be willing to adjust your lifestyle and prioritize your financial goals. After credit counseling, maintain the habits you've learned. Continue to track your spending, stick to your budget, and make your payments on time. Don't let your guard down and fall back into old habits. By following these tips, you can make the most of credit counseling and set yourself up for long-term financial success. Remember, credit counseling is a tool to help you achieve your financial goals. It's not a magic bullet, but it can provide you with the guidance and support you need to get your finances back on track.

Overcoming Financial Challenges

Overcoming financial challenges requires a combination of knowledge, discipline, and support. Start by educating yourself about personal finance and debt management. Then, create a realistic budget and stick to it as closely as possible. If you're struggling with debt, consider seeking help from a credit counselor. They can help you develop a debt management plan and negotiate with your creditors. Finally, remember to stay positive and persistent. Overcoming financial challenges takes time and effort, but it is possible to achieve your goals with the right mindset and strategies.

One of the biggest financial challenges people face is managing unexpected expenses. Life is full of surprises, and not all of them are pleasant. Car repairs, medical bills, and home repairs can all derail your budget and set you back financially. The key to overcoming these challenges is to have a plan in place. Start by building an emergency fund. This is a savings account specifically for unexpected expenses. Aim to save at least three to six months' worth of living expenses in your emergency fund. Next, consider purchasing insurance to protect yourself against financial losses. Health insurance, car insurance, and homeowners insurance can all help you cover unexpected costs. Finally, be flexible and adaptable. If you encounter an unexpected expense, don't panic. Take a deep breath and assess the situation. See if you can cut back on other expenses to free up money for the unexpected cost. Overcoming financial challenges is not always easy, but it is possible with the right mindset and strategies. By educating yourself, creating a budget, building an emergency fund, and purchasing insurance, you can protect yourself against financial losses and achieve your financial goals. Don't be afraid to seek help from a financial advisor or credit counselor if you need it.

Fun Facts About Budgeting

Did you know that the word "budget" comes from the Old French word "bougette," which means "leather bag"? In the past, budgets were often kept in leather bags. Another fun fact is that the average American household has about $16,000 in credit card debt. Finally, studies have shown that people who budget are more likely to achieve their financial goals and have lower levels of stress.

One fun fact about budgeting is that it can actually be quite creative. Many people think of budgeting as a restrictive and boring process, but it can be an opportunity to explore your values and priorities. By making conscious choices about how you spend your money, you can create a life that aligns with your passions and goals. Another fun fact is that budgeting can be a social activity. You can share your budgeting tips and strategies with friends and family, or even join a budgeting group. This can help you stay motivated and accountable. Finally, budgeting can be a learning experience. As you track your spending and analyze your financial data, you'll gain a deeper understanding of your habits and behaviors. This knowledge can empower you to make smarter financial decisions in the future. So, don't be afraid to have fun with budgeting. Experiment with different methods and approaches until you find what works best for you. Embrace the challenge and enjoy the process of taking control of your finances. Who knows, you might even discover a hidden talent for budgeting! Remember, budgeting is not about depriving yourself; it's about making conscious choices that support your financial well-being and help you achieve your goals. It's about creating a life that is both financially secure and personally fulfilling.

How to Credit Counseling

The first step in seeking credit counseling is to find a reputable agency that is accredited by a trusted organization, such as the NFCC. You can search online for credit counseling agencies in your area or contact the NFCC for a referral. Once you've found an agency, schedule a consultation with a credit counselor. During the consultation, the counselor will review your financial situation and discuss your options. If you decide to enroll in a debt management plan, the counselor will work with you to create a budget and negotiate with your creditors.

Before initiating credit counseling, gather all relevant financial documents. This includes your credit reports from all three major bureaus (Equifax, Experian, and Trans Union), statements from your credit cards, loans, and other debts, as well as your income and expense records. Having this information readily available will streamline the counseling process and enable the counselor to provide more accurate and personalized advice. During your credit counseling session, be prepared to discuss your financial goals, challenges, and concerns. The counselor will ask you about your income, expenses, debts, and assets to gain a comprehensive understanding of your financial situation. Be honest and transparent with the counselor, as this will help them develop a plan that is tailored to your specific needs. If you decide to enroll in a debt management plan (DMP), the counselor will work with you to create a budget that prioritizes debt repayment. The DMP involves making monthly payments to the credit counseling agency, which then distributes the funds to your creditors. By consolidating your debts and making regular payments, you can gradually reduce your debt burden and improve your credit score. Credit counseling is a valuable resource for individuals and families who are struggling with debt or seeking to improve their financial literacy. By following these steps, you can access the guidance and support you need to achieve your financial goals and build a brighter future.

What If Credit Counseling

What if you're hesitant to seek credit counseling because you're worried about the cost? Many non-profit credit counseling agencies offer free or low-cost services. What if you're concerned about the impact on your credit score? While enrolling in a debt management plan may temporarily lower your score, the long-term benefits of reducing debt and improving your credit habits will outweigh the short-term drawbacks. What if you're not sure if credit counseling is right for you? You can schedule a free consultation with a credit counselor to discuss your options and see if it's a good fit.

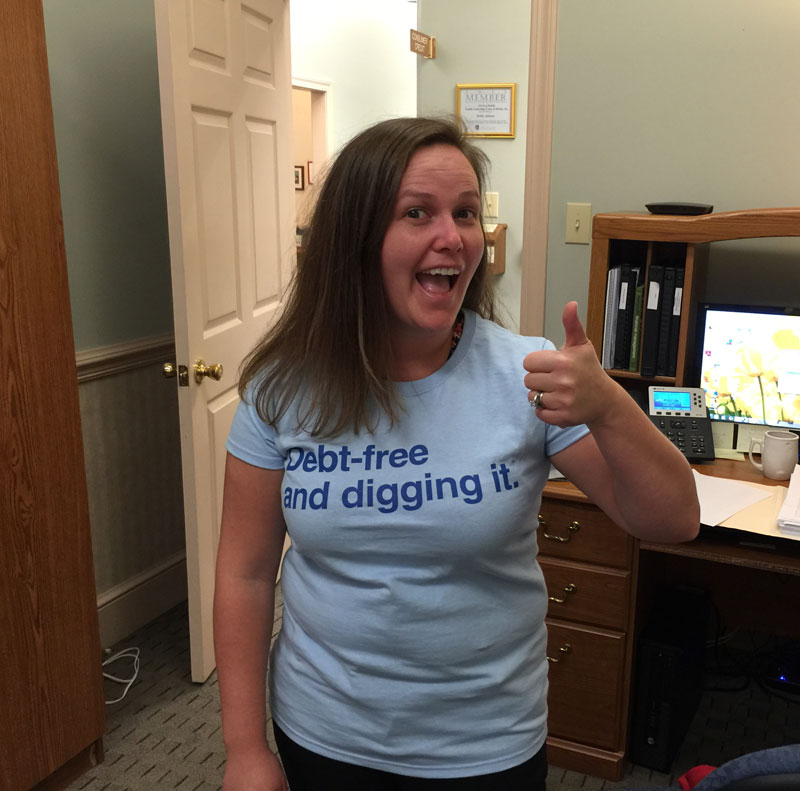

What if you start credit counseling but find it difficult to stick to the budget? This is a common challenge, but it's important to remember that budgeting is a skill that takes time and practice to develop. Don't get discouraged if you slip up or make mistakes. Just keep learning and growing, and you will eventually find a budgeting system that works for you. What if you enroll in a debt management plan but then experience a financial setback, such as job loss or medical emergency? Contact your credit counselor immediately. They may be able to adjust your payment plan or provide you with other resources to help you through the difficult time. What if you complete your debt management plan and become debt-free? Celebrate your success and maintain the good financial habits you've learned. Continue to track your spending, stick to your budget, and make your payments on time. This will help you stay on track and avoid getting into debt again. Credit counseling is a valuable resource, but it's not a magic bullet. It requires ongoing effort and commitment to achieve your financial goals. By addressing these "what if" scenarios, you can prepare yourself for the challenges and opportunities that may arise during your credit counseling journey.

Listicle of Credit Counseling

1. Find a reputable credit counseling agency.

2. Schedule a consultation with a credit counselor.

3. Gather your financial documents.

4. Discuss your financial goals and challenges.

5. Create a budget and debt management plan.

6. Make your payments on time.

7. Track your progress and celebrate your successes.

8. Stay positive and persistent.

9. Educate yourself about personal finance.

10. Maintain good financial habits after completing your debt management plan.

1. Research different credit counseling agencies to find one that is reputable and accredited. Check online reviews and ratings to get a sense of their services and reputation.

2. Schedule a consultation with a credit counselor to discuss your financial situation and goals. This is an opportunity to ask questions and get a personalized assessment of your options.

3. Gather all your financial documents, including credit reports, bank statements, and bills. Having this information readily available will streamline the counseling process.

4. Be honest and transparent with your credit counselor about your financial habits, challenges, and concerns. This will help them develop a plan that is tailored to your specific needs.

5. Work with your credit counselor to create a budget and debt management plan that is realistic and sustainable. Make sure you understand the terms and conditions of the plan before enrolling.

6. Make your payments on time and in full each month. This is crucial for staying on track with your debt repayment goals.

7. Track your progress and celebrate your successes along the way. This will help you stay motivated and committed to your financial journey.

8. Stay positive and persistent, even when you encounter setbacks. Building better financial habits takes time and effort, so don't get discouraged if you slip up or make mistakes.

9. Educate yourself about personal finance and debt management. The more you know, the better equipped you'll be to make informed financial decisions.

10. After completing your debt management plan, continue to maintain good financial habits, such as budgeting, saving, and using credit responsibly. This will help you avoid getting into debt again and achieve your long-term financial goals. Credit counseling can be a valuable resource for individuals and families who are struggling with debt or seeking to improve their financial literacy. By following these steps, you can access the guidance and support you need to achieve your financial goals and build a brighter future.

Question and Answer

Q: What is credit counseling?

A: Credit counseling is a service that provides individuals and families with education, guidance, and support to manage their finances effectively, reduce debt, and improve their credit scores.

Q: How does credit counseling work?

A: Credit counseling agencies typically offer services such as budget counseling, debt management plans, and financial education workshops. They work with clients to assess their financial situation, create a budget, negotiate with creditors, and develop a plan for debt repayment.

Q: How much does credit counseling cost?

A: Many non-profit credit counseling agencies offer free or low-cost services. However, some agencies may charge fees for certain services, such as debt management plans. Be sure to ask about the agency's fees and services before signing up for a plan.

Q: Will credit counseling hurt my credit score?

A: Enrolling in a debt management plan may temporarily lower your credit score, but the long-term benefits of reducing debt and improving your credit habits will outweigh the short-term drawbacks. Credit counseling agencies can also help you improve your credit score by providing education and guidance on responsible credit use.

Conclusion of Credit Counseling Budget Planning: Build Better Habits

Ultimately, credit counseling and budget planning are powerful tools that can empower you to take control of your finances and build a brighter future. By understanding your spending habits, creating a realistic budget, and seeking professional guidance when needed, you can achieve your financial goals and live a more secure and fulfilling life. Start today, and you'll be amazed at the progress you can make!

Post a Comment