Free Debt Management Budget Spreadsheet Template

Are you tired of juggling bills and feeling overwhelmed by debt? You're not alone! Many people struggle to keep track of their finances and find themselves trapped in a cycle of debt. But what if I told you there was a simple, free tool that could help you regain control and pave the way to financial freedom?

Trying to manage debt without a clear picture of your income and expenses can feel like navigating a maze blindfolded. It's difficult to know where your money is going, which debts to prioritize, and how to make meaningful progress towards becoming debt-free. It's frustrating when you feel like you're working hard but not seeing the results you desire. The mental load of constant worry about finances can take a toll on your well-being and relationships.

This blog post is all about providing you with a free debt management budget spreadsheet template to help you take charge of your finances, understand your spending habits, and strategically plan your debt repayment. It will help you organize your financial information, visualize your progress, and ultimately, achieve your financial goals.

This article explored the benefits of using a free debt management budget spreadsheet template to gain control over your finances. We discussed how it can help you track income and expenses, prioritize debts, and develop a personalized repayment plan. By using a template, you can visualize your progress, stay motivated, and ultimately achieve your goals of becoming debt-free. Key concepts explored included debt management, budgeting, financial planning, and spreadsheet templates.

My Personal Experience with Debt and the Power of Budgeting

I vividly remember the feeling of dread that would wash over me every time I opened my email. Credit card bills, loan statements, and the constant reminder that I was sinking deeper into debt. It was a dark period in my life, fueled by impulsive spending and a complete lack of financial awareness. I knew I needed to change, but I didn't know where to start. That's when I stumbled upon the concept of budgeting, and more specifically, using a spreadsheet to track my income, expenses, and debts. It was a game-changer. Suddenly, I had a clear picture of my financial situation. I could see exactly where my money was going, and I could identify areas where I could cut back. Creating a debt management plan within the spreadsheet allowed me to prioritize my debts based on interest rates and strategize my repayment. The feeling of empowerment and control I gained was immense. It wasn't an overnight fix, but it was the first step towards reclaiming my financial life. I started with a simple template, tweaking it to suit my individual needs and goals. Over time, it evolved into a comprehensive tool that I still use today. Because of that personal experience, I am now able to share how that tool made me overcome debt.

The realization that so many others struggle with similar financial challenges inspired me to share this resource with you. The free debt management budget spreadsheet template is more than just a tool; it's a pathway to financial literacy and empowerment. It equips you with the knowledge and control you need to make informed decisions and achieve your financial goals. It's about building a brighter financial future for yourself and your family. It is possible, with the right tools and resources, to conquer debt and achieve financial peace.

What is a Free Debt Management Budget Spreadsheet Template?

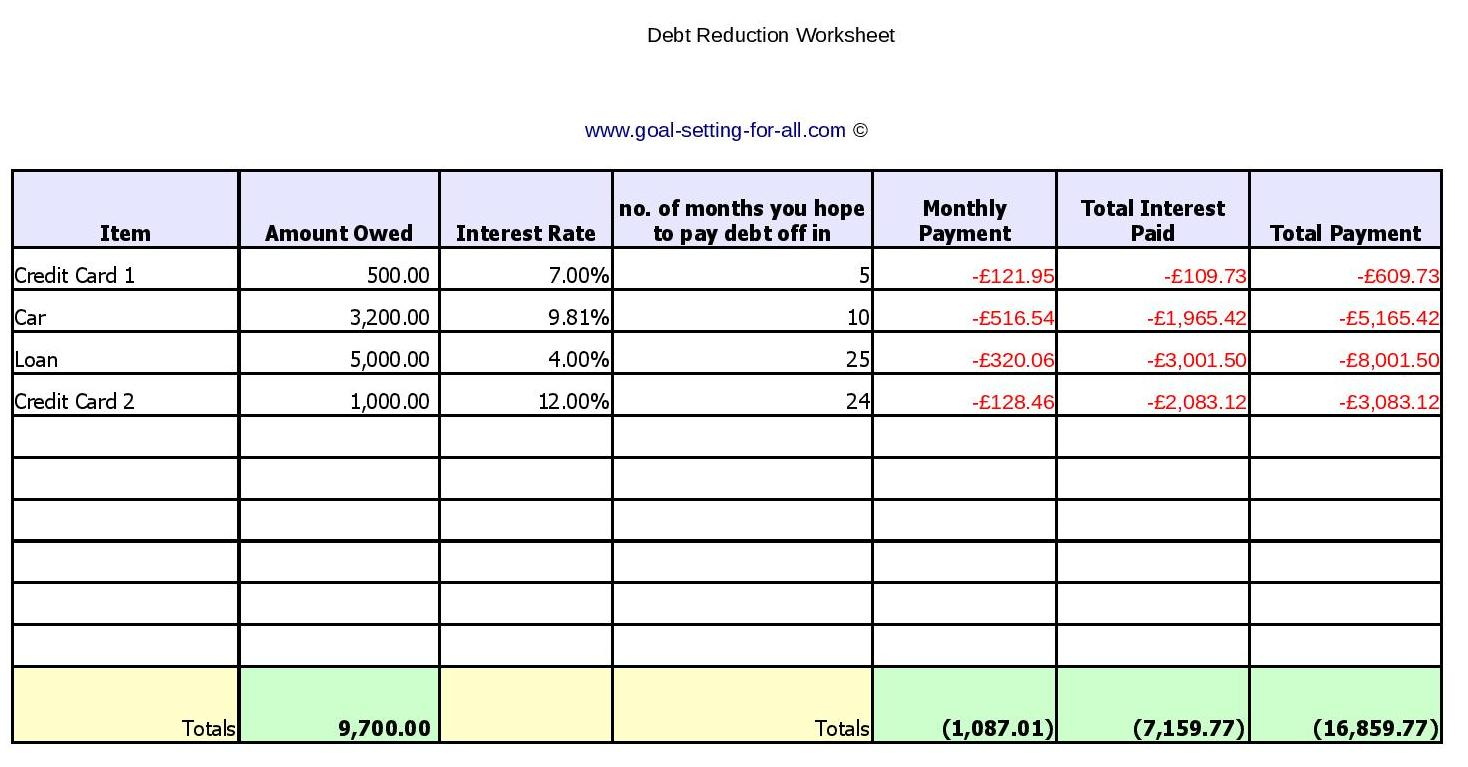

A free debt management budget spreadsheet template is a pre-designed digital document, typically created in programs like Microsoft Excel or Google Sheets, that helps individuals track their income, expenses, and debts in an organized manner. It provides a structured framework for creating a budget, identifying areas where spending can be reduced, and developing a strategic plan for debt repayment. The template typically includes sections for listing income sources, categorizing expenses, and tracking outstanding debts with details like interest rates and minimum payments.

These templates are designed to be user-friendly, often incorporating formulas and charts that automatically calculate totals, visualize spending patterns, and project debt repayment timelines. By inputting their financial data into the template, users can gain a clear understanding of their cash flow, identify areas where they can save money, and prioritize their debt repayments. The "free" aspect of these templates makes them accessible to a wide range of individuals who may not have the resources to invest in expensive financial software or services. It is a starting point for many people to become debt free. A debt management spreadsheet is the first step in a debt management plan.

The History and Myth of Debt Management

The concept of debt management has been around for centuries, although the tools and techniques have evolved significantly over time. In ancient civilizations, debt was often a consequence of agricultural failures or unexpected disasters. Early forms of debt management involved bartering goods or services to repay obligations. As societies developed, formal lending practices emerged, and with them, the need for strategies to manage debt effectively.

One common myth surrounding debt management is that it's only for people with severe financial problems. This misconception prevents many individuals from seeking help or taking proactive steps to address their debt before it becomes overwhelming. In reality, debt management strategies can be beneficial for anyone looking to improve their financial health, regardless of their current debt level. Another myth is that debt management is a quick fix. While it can provide immediate relief by consolidating debts or lowering interest rates, it requires discipline and commitment to implement and maintain a long-term repayment plan. It is not magic. You still need to work to free yourself from debt. This is where a Debt Management Budget Spreadsheet Template can help!

The Hidden Secret to Mastering Your Budget Spreadsheet

The hidden secret to mastering your free debt management budget spreadsheet template isn't just about entering numbers; it's about understanding the story those numbers tell. Many people treat their budget as a static document, something they create once and then forget about. But the real power lies in actively analyzing the data, identifying trends, and making adjustments based on your findings. It is about getting insights from your data.

For example, you might notice that you're consistently overspending on dining out. Instead of just acknowledging the problem, dig deeper. What specific factors are contributing to this? Are you eating out due to lack of time to cook, social pressure, or emotional reasons? Once you understand the underlying causes, you can develop targeted solutions. The template is your roadmap, but you're the driver. Regularly review your progress, celebrate your successes, and don't be afraid to experiment with different strategies until you find what works best for you. Consistency and a willingness to adapt are the keys to unlocking the full potential of your debt management budget spreadsheet template.

Recommendations for a Free Debt Management Budget Spreadsheet Template

When choosing a free debt management budget spreadsheet template, prioritize simplicity and clarity. A template that is overly complicated or filled with unnecessary features can be overwhelming and discourage you from using it consistently. Look for a template that is easy to navigate, with clear sections for income, expenses, and debts. It should also include built-in formulas that automatically calculate totals and provide insights into your spending habits.

Consider templates that offer features like debt prioritization tools, which can help you determine which debts to pay off first based on interest rates or other factors. Also, look for templates that allow for customization, so you can tailor them to your specific needs and financial goals. Many free templates are available online from reputable sources, such as financial websites or credit counseling agencies. Experiment with a few different options to find one that resonates with you and fits your personal style. Remember, the best template is the one that you will actually use consistently.

Breaking Down Budgeting Categories for Effective Debt Management

To maximize the effectiveness of your free debt management budget spreadsheet template, it's essential to break down your budgeting categories with a high degree of precision. Instead of lumping all your "entertainment" expenses together, consider creating separate categories for "movies," "concerts," "dining out," and subscriptions.This level of detail allows you to pinpoint exactly where your money is going and identify areas where you can realistically cut back.

For example, if you find that you're spending a significant amount on streaming services, you might consider canceling a few subscriptions or opting for a less expensive bundle. Similarly, if you're spending a lot on dining out, you could try cooking more meals at home or packing your lunch for work. The more granular your categories, the more insights you'll gain into your spending habits, and the easier it will be to make informed decisions about how to allocate your resources. Remember to include categories for essential expenses like housing, transportation, utilities, and groceries. A well-defined budget is the foundation for successful debt management.

Tips for Maximizing Your Budget Spreadsheet

One of the most effective tips for maximizing your free debt management budget spreadsheet template is to automate as much of the data entry as possible. Instead of manually entering every transaction, link your bank accounts and credit cards to your spreadsheet using a secure third-party service. This will automatically import your transactions, saving you time and reducing the risk of errors. You can also set up rules to automatically categorize transactions based on the vendor or description, further streamlining the process. Consistency is key to long-term success. It is best to set reminders.

Another valuable tip is to regularly review and reconcile your budget. Set aside a specific time each week or month to compare your actual spending to your budgeted amounts. Identify any discrepancies and investigate the reasons behind them. This will help you stay on track and make necessary adjustments to your budget. Additionally, don't be afraid to experiment with different budgeting methods to find what works best for you. Some people prefer a zero-based budget, where every dollar is allocated to a specific purpose, while others prefer a more flexible approach. The most important thing is to find a system that you can stick with long-term.

Customizing Your Free Budget Spreadsheet Template

Tailoring the template to your unique circumstances is key to long-term success. Begin by adding or removing categories that align with your spending habits. If you have a pet, create a "Pet Care" category. If you're saving for a specific goal, such as a down payment on a house, add a "Savings Goal" category. The more personalized your template is, the more relevant and useful it will be.

Consider adding columns to track the progress of your debt repayment efforts. You might include columns for "Debt Balance," "Interest Rate," "Minimum Payment," and "Extra Payment." This will allow you to visualize your debt reduction over time and stay motivated. You can also use conditional formatting to highlight debts with high interest rates or to track your progress towards paying off each debt. Don't be afraid to experiment with different features and functionalities to create a template that truly works for you.

Fun Facts About Budgeting and Debt Management

Did you know that budgeting can actually reduce stress? Studies have shown that people who budget regularly report feeling more in control of their finances and less anxious about money. It's like having a financial GPS that guides you towards your goals and helps you avoid unexpected roadblocks. Another fun fact is that the average millionaire still budgets! Despite having significant wealth, they understand the importance of tracking their income and expenses to maintain their financial stability.

Debt management is not a punishment; it's an opportunity. It's a chance to learn about your financial habits, develop better money management skills, and build a more secure financial future. Think of it as a journey of self-discovery, where you uncover your strengths and weaknesses when it comes to money. The more you understand about yourself and your relationship with money, the better equipped you'll be to make smart financial decisions and achieve your goals.

How to Get Your Free Debt Management Budget Spreadsheet Template

Obtaining your free debt management budget spreadsheet template is easier than you might think! A quick search on the internet using search engines like Google, Duck Duck Go, or Bing will lead you to numerous websites offering free templates for download. Look for reputable sources such as financial institutions, credit counseling agencies, or personal finance blogs. These sources are more likely to provide high-quality, accurate templates that are tailored to debt management.

Another option is to create your own template from scratch using spreadsheet software like Microsoft Excel or Google Sheets. While this may require a bit more effort upfront, it allows you to customize the template to your exact needs and preferences. Many online tutorials and guides can walk you through the process of creating a budget spreadsheet, including adding formulas, creating charts, and incorporating debt tracking features. It is up to you to choose.

What If You Fall Behind on Your Budget?

Falling behind on your budget is not a sign of failure; it's a normal part of the process. Everyone makes mistakes or encounters unexpected expenses from time to time. The key is to not get discouraged and to take corrective action as quickly as possible. The first step is to identify the reasons why you fell behind. Was it due to overspending in a particular category, a loss of income, or an unforeseen expense? Once you understand the cause, you can develop a plan to address it.

If you overspent in a particular category, try to cut back on spending in that area for the remainder of the month. If you experienced a loss of income, explore ways to increase your earnings, such as taking on a side hustle or selling unwanted items. If you encountered an unforeseen expense, adjust your budget for the following month to account for the extra cost. The template is your plan, and you can adjust it accordingly.

Listicle of Debt Management Strategies

1.The Debt Snowball Method: Focus on paying off your smallest debts first, regardless of interest rate, to build momentum and motivation.

2.The Debt Avalanche Method: Prioritize paying off debts with the highest interest rates first, to minimize the total amount of interest you pay over time.

3.Balance Transfers: Transfer high-interest debt to a credit card with a lower interest rate or a promotional 0% APR period.

4.Debt Consolidation Loans: Combine multiple debts into a single loan with a fixed interest rate and monthly payment.

5.Credit Counseling: Work with a non-profit credit counseling agency to develop a debt management plan and negotiate with creditors.

6.Negotiate with Creditors: Contact your creditors and ask if they are willing to lower your interest rate, waive fees, or offer a payment plan.

7.Increase Income: Explore ways to increase your income, such as taking on a side hustle or selling unwanted items, and use the extra money to pay down debt.

8.Reduce Expenses: Identify areas where you can cut back on spending and use the savings to pay down debt.

9.Use a Budgeting App: Utilize a budgeting app to track your income, expenses, and debt in real-time and identify areas for improvement.

10.Seek Professional Help: Consider consulting with a financial advisor for personalized guidance and support.

Question and Answer

Q: Is a free debt management budget spreadsheet template really effective?

A: Absolutely! While it's not a magic bullet, a well-designed template can provide the structure and clarity you need to take control of your finances and make informed decisions about debt repayment. It's the first step towards taking control.

Q: I'm not good with spreadsheets. Can I still use a template?

A: Yes! Most templates are designed to be user-friendly, with clear instructions and pre-built formulas. You don't need to be an Excel expert to use them effectively.

Q: How often should I update my budget spreadsheet?

A: Ideally, you should update your spreadsheet at least once a week to track your income and expenses and ensure you're staying on track.

Q: What if my income is irregular? Can I still use a budget spreadsheet?

A: Yes! You'll just need to adjust your approach. Estimate your income for the month based on your average earnings and adjust your spending accordingly. You can also create a buffer in your budget to account for fluctuations in income.

Conclusion of Free Debt Management Budget Spreadsheet Template

Taking control of your finances and conquering debt is achievable with the right tools and strategies. A free debt management budget spreadsheet template provides a valuable framework for tracking income, expenses, and debts, allowing you to develop a personalized repayment plan and stay motivated on your journey towards financial freedom. Remember to customize the template to your unique needs, track your progress regularly, and don't be afraid to seek help when needed. Embrace the power of budgeting and take the first step towards a brighter financial future!

Post a Comment