Student Loan Forgiveness for Accountants: Options Available

So, you've crunched the numbers, balanced the books, and filed the taxes. You're an accountant, making a difference in the financial world. But there's one set of numbers that might still be causing you a headache: your student loans.

Graduating with a mountain of student debt is a common reality, especially for those who pursued higher education to excel in their careers. Many accountants find themselves in a similar situation, juggling loan repayments with the demands of their profession, hoping to find a light at the end of the tunnel.

This blog post is designed to shed light on the available options for student loan forgiveness specifically tailored for accountants. We'll explore various programs, eligibility requirements, and tips to navigate the often-complex world of student loan relief. Let's dive in and discover how you can potentially alleviate some of that financial burden.

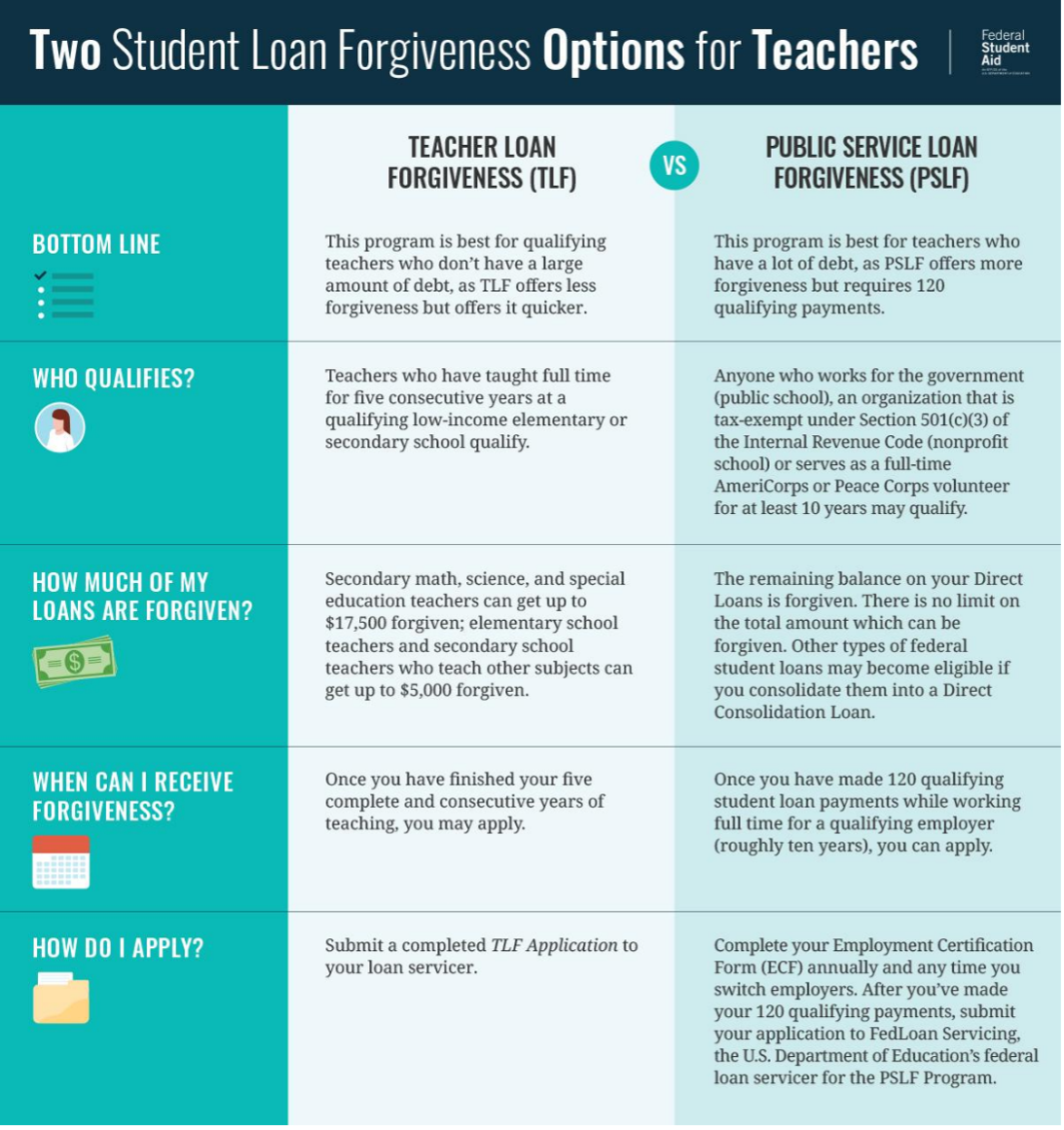

We'll cover the main avenues for loan forgiveness, like Public Service Loan Forgiveness (PSLF) and income-driven repayment (IDR) plans, highlighting how they can work for accountants in various employment settings. You'll learn about eligibility criteria, required documentation, and strategies for maximizing your chances of approval. Keywords like student loan forgiveness, accountants, PSLF, income-driven repayment, and financial relief will be key to your understanding.

Understanding Public Service Loan Forgiveness (PSLF)

The goal of PSLF is to encourage talented individuals like yourself to enter public service professions, even if they have significant student loan debt. I remember when I first heard about PSLF, it seemed almost too good to be true. A friend of mine, a social worker with a master's degree and a hefty loan balance, was the one who initially told me about it. She was working for a non-profit organization and diligently making her qualifying payments, hopeful that after ten years, her remaining debt would be forgiven. It was inspiring to see her commitment to her career despite the financial burden, knowing that PSLF offered a potential path to relief.

For accountants, this can apply if you work for a qualifying non-profit organization, a government agency (federal, state, or local), or certain other types of public service employers. The core requirement is consistent employment in a qualifying role and making 120 qualifying monthly payments while on an income-driven repayment plan. The beauty of PSLF is that any remaining balance is forgiven after the 120th qualifying payment. The program is meant to provide debt relief for those committed to careers that serve the public good, and that includes the valuable financial expertise accountants bring to those organizations.

Exploring Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans are designed to make your monthly student loan payments more manageable by basing them on your income and family size. These plans can significantly lower your monthly payments, making it easier to manage your finances while working towards loan forgiveness. The key to IDR plans is that if you still have a remaining balance after 20 or 25 years of qualifying payments (depending on the specific plan), that balance is forgiven.

Several IDR plans are available, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Saving on a Valuable Education (SAVE), and Income-Contingent Repayment (ICR). Each plan has its own eligibility requirements and formulas for calculating your monthly payment. The best plan for you will depend on your individual financial circumstances, including your income, family size, and the type of federal student loans you have. Remember to recertify your income and family size annually to ensure your payments remain accurately adjusted.

The History and Myths of Student Loan Forgiveness

The concept of student loan forgiveness isn't new. The first federal student loan programs were established in the mid-20th century, and the idea of providing some form of relief to borrowers has been around for decades. However, the landscape of student loan forgiveness has evolved significantly over time, with various programs being introduced, modified, and sometimes even eliminated. Over the years, many myths have sprung up around student loan forgiveness. One common myth is that it's "free money" or a handout. In reality, these programs often require years of consistent payments, adherence to strict eligibility criteria, and often involve working in specific public service roles.

Another myth is that student loan forgiveness is a guaranteed outcome for everyone. Unfortunately, that's not the case. Approval rates can vary, and many borrowers may find that they don't qualify for the programs they initially hoped to pursue. Understanding the facts and separating them from the fiction is crucial when navigating the complex world of student loan forgiveness.

Unveiling the Secrets of Maximizing Your Forgiveness Potential

One key secret to maximizing your forgiveness potential is meticulous record-keeping. Keep copies of everything related to your student loans: your loan documents, payment history, employment certifications, and any correspondence with your loan servicer. This documentation will be invaluable if you ever need to prove your eligibility for forgiveness or resolve any disputes. Another secret is to stay informed about the ever-changing landscape of student loan forgiveness programs. Policies and regulations can change, so it's essential to stay updated on the latest developments.

Consider subscribing to newsletters from reputable student loan advocacy organizations or following relevant government agencies on social media. Finally, don't be afraid to seek professional guidance. A qualified financial advisor or student loan expert can help you navigate the complexities of the various programs and develop a personalized strategy to maximize your chances of forgiveness.

Recommendations for Accountants Seeking Loan Forgiveness

First and foremost, thoroughly research all available student loan forgiveness programs and carefully assess your eligibility for each. Don't assume that you automatically qualify for a particular program; take the time to understand the specific requirements and ensure that you meet them. Next, carefully evaluate your employment situation. If you're currently working in a for-profit setting, consider exploring opportunities in the non-profit or government sectors to potentially qualify for PSLF.

If you're already working in a qualifying role, make sure to submit your employment certification forms annually to ensure that your employment is being properly tracked. Finally, be proactive in managing your student loans. Don't wait until you're struggling to make payments; explore your options and take action to find a repayment plan that works for you. By taking these steps, you can significantly improve your chances of achieving student loan forgiveness and freeing up your financial resources.

Understanding Consolidation and Its Impact

Consolidation involves combining multiple federal student loans into a single new loan. This can simplify your repayment process by having just one monthly payment to manage instead of several. However, it's important to understand that consolidation can also impact your eligibility for certain loan forgiveness programs. For example, consolidating your loans can sometimes reset the clock on your qualifying payments for PSLF. This means that the payments you made on your original loans before consolidation may not count towards the 120 qualifying payments required for forgiveness.

Carefully consider the pros and cons of consolidation before making a decision. If you're pursuing PSLF, it's generally advisable to avoid consolidating your loans unless absolutely necessary. If you do consolidate, be sure to confirm with your loan servicer how it will affect your progress towards forgiveness. Also, it's important to remember that only federal student loans can be consolidated through a federal consolidation loan. Private student loans cannot be consolidated into a federal loan and therefore wouldn't be eligible for federal loan forgiveness programs.

Practical Tips for Navigating the Forgiveness Process

One of the most important tips is to stay organized. Create a system for tracking all of your student loan documents, payment records, and correspondence with your loan servicer. This will make it much easier to navigate the forgiveness process and ensure that you have all the necessary information readily available. Another tip is to communicate regularly with your loan servicer. If you have any questions or concerns, don't hesitate to reach out to them for clarification.

Keep a record of all your communications, including the date, time, and the name of the person you spoke with. Finally, be patient. The student loan forgiveness process can sometimes be slow and bureaucratic. Don't get discouraged if you encounter delays or setbacks; just keep following up and advocating for yourself.

The Importance of Accurate Information

Ensuring that all the information you provide on your loan forgiveness applications is accurate and complete is critical. Any errors or omissions can delay the processing of your application or even lead to denial. Double-check all of your information before submitting your application, and be sure to provide any supporting documentation that is requested.

If you're unsure about any aspect of the application process, seek guidance from your loan servicer or a qualified financial advisor. Remember, it's always better to be cautious and thorough than to risk making a mistake that could jeopardize your chances of forgiveness.

Fun Facts About Student Loans and Forgiveness

Did you know that the first federal student loan program was established in 1958 as part of the National Defense Education Act? It was created in response to the Soviet Union's launch of Sputnik and aimed to encourage more students to pursue careers in science and engineering. Another fun fact is that the average student loan debt for the class of 2020 was over $38,000. This highlights the significant financial burden that many graduates face as they enter the workforce. While student loan debt can be daunting, the good news is that there are various forgiveness programs available to help borrowers manage their debt and achieve financial freedom.

Student loan forgiveness programs are designed to address different needs and circumstances. Some programs, like PSLF, focus on encouraging public service, while others, like income-driven repayment plans, aim to make loan payments more affordable based on borrowers' income and family size.

How to Apply for Student Loan Forgiveness

The application process for student loan forgiveness varies depending on the specific program you're pursuing. For PSLF, you'll need to submit an Employment Certification Form (ECF) annually or whenever you change employers. This form verifies that you're working for a qualifying employer and that your employment qualifies for the program. After you've made 120 qualifying payments, you'll need to submit an application for forgiveness.

For income-driven repayment plans, you'll need to apply through your loan servicer and provide documentation of your income and family size. You'll need to recertify your income and family size annually to ensure that your payments are accurately adjusted. It's important to carefully review the application instructions for each program and provide all the required documentation. If you have any questions or need assistance with the application process, don't hesitate to contact your loan servicer.

What Happens If Your Application is Denied?

If your application for student loan forgiveness is denied, don't lose hope. The first step is to understand the reason for the denial. Your loan servicer should provide you with a written explanation of why your application was rejected. Once you understand the reason, you can take steps to address the issue.

If the denial was due to an error on your application, you can correct the mistake and resubmit the application. If the denial was due to your employment not qualifying for PSLF, you may need to explore other employment options or pursue a different forgiveness program. You can also appeal the decision if you believe that the denial was made in error. Be sure to gather any supporting documentation that can help support your appeal. Remember, it's important to stay persistent and advocate for yourself throughout the process.

Listicle of Student Loan Forgiveness Options for Accountants

Navigating the world of student loans can be overwhelming, but knowing your options is the first step toward financial freedom. Here’s a quick list of potential loan forgiveness paths for accountants:

- Public Service Loan Forgiveness (PSLF): Ideal if you work for a qualifying non-profit or government agency. Requires 120 qualifying payments.

- Income-Driven Repayment (IDR) Plans: Payments are based on your income and family size. After 20-25 years, the remaining balance is forgiven.

- National Health Service Corps Loan Repayment Program: If you're a CPA working in a health professional shortage area, this could be an option.

- State-Specific Programs: Some states offer loan repayment assistance to professionals in high-need areas.

- Employer-Sponsored Programs: Check if your employer offers any loan repayment assistance as a benefit.

Each option has specific requirements, so research thoroughly to find the best fit for your situation.

Question and Answer Section

Q: What types of accounting jobs qualify for Public Service Loan Forgiveness (PSLF)?

A: Any accounting role within a qualifying non-profit organization or government agency can qualify for PSLF. This includes roles like staff accountant, auditor, budget analyst, and financial manager.

Q: How do I know if my employer is a qualifying employer for PSLF?

A: Generally, government organizations at any level (federal, state, local, or tribal) and non-profit organizations that are tax-exempt under section 501(c)(3) of the Internal Revenue Code qualify. However, it's always best to confirm with the organization and submit an Employment Certification Form to the Department of Education.

Q: Can I consolidate my student loans and still qualify for PSLF?

A: Yes, but it's important to understand the implications. Consolidating your loans can reset the clock on your qualifying payments for PSLF. Only payments made on the consolidated loan will count towards the 120 qualifying payments. If you've already made qualifying payments on your original loans, carefully weigh the pros and cons of consolidation before proceeding.

Q: What happens if my income increases significantly while I'm on an income-driven repayment plan?

A: If your income increases, your monthly payments under an income-driven repayment plan will also increase. However, even if your income rises significantly, you can still qualify for loan forgiveness after making the required number of qualifying payments (20 or 25 years, depending on the plan).

Conclusion of Student Loan Forgiveness for Accountants: Options Available

Navigating student loan forgiveness can feel like balancing a complex ledger, but understanding the options available is the first step toward finding relief. Public Service Loan Forgiveness (PSLF) offers a promising path for accountants working in non-profit or government sectors, while Income-Driven Repayment (IDR) plans provide a safety net with payments tailored to your income and family size. Meticulous record-keeping, proactive communication with your loan servicer, and staying informed about policy changes are crucial for maximizing your chances of success. By exploring these avenues and understanding the nuances of each program, you can pave the way toward financial freedom and focus on your career with less financial burden. Student loan forgiveness for accountants is achievable with knowledge, planning, and persistence.

Post a Comment