Debt Consolidation Loan Calculator: Compare Options

Drowning in debt? Feeling like you're juggling multiple bills and interest rates, with no clear end in sight? There's a light at the end of the tunnel! Understanding your options is the first step toward a brighter financial future.

Many people find themselves overwhelmed by the sheer number of debts they're managing. Keeping track of due dates, interest rates, and minimum payments across various credit cards and loans can feel like a full-time job. It's easy to miss payments, incur late fees, and watch your credit score suffer. Furthermore, high interest rates can significantly increase the total amount you repay over time, making it harder to escape the cycle of debt.

This article is designed to help you navigate the world of debt consolidation loans. We'll explore how a debt consolidation loan calculator can empower you to compare different loan options and make informed decisions about your financial future. We will delve into various aspects of debt consolidation, from understanding the basics to uncovering hidden secrets, providing you with the knowledge you need to take control of your debt.

Debt consolidation loans can be a powerful tool for simplifying your finances and potentially saving money on interest. Using a debt consolidation loan calculator allows you to compare loan options, understand monthly payments, and assess the overall cost of consolidating your debt. We'll cover everything from the benefits of debt consolidation to potential drawbacks, ensuring you're well-equipped to make the right choice for your situation. Understanding the nuances of debt consolidation and utilizing a calculator is key to regaining control of your finances and achieving financial freedom.

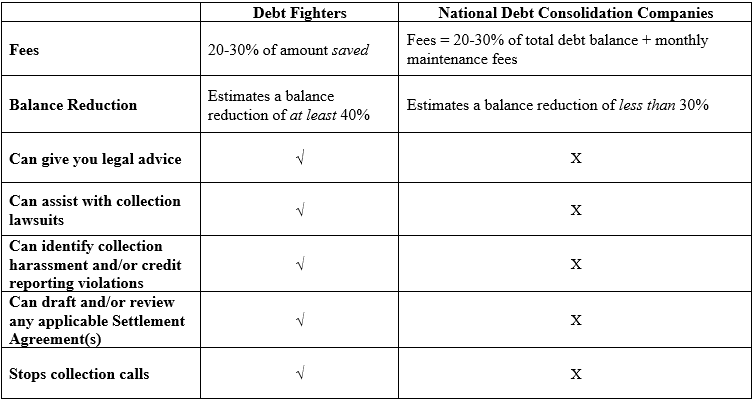

Compare Options

I remember when I first started feeling overwhelmed by credit card debt. I had several cards with balances, each with different interest rates and due dates. It was a constant struggle to keep track of everything, and I felt like I was just treading water. I started looking into debt consolidation as a potential solution, but the sheer number of options was daunting. That's when I discovered the power of a debt consolidation loan calculator. Suddenly, I could input my debt information and see how different loan terms and interest rates would impact my monthly payments and the total amount I would repay. It was a game-changer! I actually felt like I could understand and compare options. A debt consolidation loan calculator is a tool that allows you to estimate your monthly payments and the total cost of a debt consolidation loan. By inputting information such as your current debt balances, interest rates, and desired loan terms, the calculator generates a detailed breakdown of your potential savings and repayment schedule. Comparing options with a calculator helps you find the loan that best fits your budget and financial goals. You can experiment with different loan amounts, interest rates, and repayment periods to see how each factor affects your monthly payments and overall cost. This empowers you to make an informed decision about whether debt consolidation is the right move for you and, if so, which loan option is the most advantageous.

Debt Consolidation Loan Calculator

A debt consolidation loan calculator is a powerful online tool designed to help you assess the financial implications of consolidating your existing debts into a single new loan. It takes into account various factors such as the total amount of your current debt, the interest rates you are currently paying on each debt, and the potential interest rate and term of a new debt consolidation loan. The calculator then crunches the numbers to provide you with an estimated monthly payment and the total amount you would pay over the life of the loan. By inputting your specific debt information, you can compare different loan options and see how each one would impact your budget and overall financial picture. This allows you to make informed decisions about whether debt consolidation is the right strategy for you and to choose the loan that best fits your needs and goals. The primary purpose of a debt consolidation loan calculator is to provide clarity and transparency in the debt consolidation process. It eliminates the guesswork and allows you to see the potential benefits and drawbacks of consolidating your debt before you commit to a loan. This empowers you to make informed financial decisions and take control of your debt.

History and Myth

The concept of debt consolidation has been around for centuries, although the specific tools and products available have evolved significantly over time. Historically, individuals have sought ways to simplify their debts and reduce their overall financial burden. In the past, this might have involved bartering, selling assets, or seeking assistance from family members. With the advent of modern financial institutions, debt consolidation loans became a more formalized and accessible option. However, some myths surrounding debt consolidation persist. One common myth is that debt consolidation is a "get out of jail free" card that magically eliminates debt. In reality, debt consolidation simply replaces multiple debts with a single loan, and you are still responsible for repaying the total amount borrowed. Another myth is that debt consolidation is always the best option for everyone. While it can be a helpful strategy for some, it is not a one-size-fits-all solution. It's crucial to carefully evaluate your individual financial situation and compare the potential costs and benefits before deciding whether debt consolidation is right for you. Understanding the history of debt consolidation and dispelling common myths can help you approach this strategy with a more informed and realistic perspective.

Hidden Secret

One often overlooked aspect of debt consolidation is the potential for negotiating a lower interest rate on your new loan. While a debt consolidation loan calculator can provide a good estimate, the actual interest rate you receive will depend on your credit score, income, and other financial factors. By improving your credit score and shopping around for the best rates, you may be able to secure a loan with a significantly lower interest rate than your current debts. This can result in substantial savings over the life of the loan. Another hidden secret is the importance of addressing the underlying causes of your debt. Debt consolidation can provide temporary relief, but if you don't change your spending habits, you may find yourself accumulating debt again in the future. It's essential to create a budget, track your expenses, and identify areas where you can cut back. By combining debt consolidation with responsible financial management, you can create a sustainable plan for long-term financial stability. Furthermore, consider the fees associated with debt consolidation loans. Some lenders may charge origination fees, prepayment penalties, or other hidden costs. Be sure to carefully review the terms and conditions of the loan before you sign anything.

Recommendation

My recommendation is to start by gathering all of your debt information, including balances, interest rates, and minimum payments. This will give you a clear picture of your current financial situation and allow you to accurately input the data into a debt consolidation loan calculator. Next, use the calculator to compare different loan options from various lenders. Pay attention to the interest rate, loan term, monthly payment, and any associated fees. Look for a loan that offers a lower interest rate than your current debts and a monthly payment that fits comfortably within your budget. Before making a final decision, check your credit score and work to improve it if possible. A higher credit score will typically qualify you for a lower interest rate on a debt consolidation loan. Also, be sure to shop around and compare offers from multiple lenders. Don't settle for the first loan you find. By taking the time to research your options and compare offers, you can find the best possible deal. Finally, remember that debt consolidation is just one piece of the puzzle. It's essential to address the underlying causes of your debt and develop a plan for responsible financial management in the future.

Understanding Interest Rates

Interest rates are a crucial factor to consider when evaluating debt consolidation loan options. The interest rate is the percentage you'll be charged on the loan balance, and it directly impacts your monthly payments and the total amount you'll repay over the life of the loan. Lower interest rates translate to lower monthly payments and less overall cost. There are two main types of interest rates: fixed and variable. A fixed interest rate remains the same throughout the loan term, providing predictable monthly payments. A variable interest rate, on the other hand, can fluctuate based on market conditions, potentially leading to unexpected changes in your monthly payments. When comparing debt consolidation loan options, pay close attention to the interest rate and whether it's fixed or variable. Also, be aware that the interest rate you qualify for will depend on your credit score, income, and other financial factors. Lenders typically offer lower interest rates to borrowers with excellent credit. To improve your chances of securing a low interest rate, work to improve your credit score, reduce your debt-to-income ratio, and shop around for the best offers from multiple lenders. Remember, even a small difference in the interest rate can save you a significant amount of money over the long term.

Tips of Debt Consolidation Loan Calculator

One of the most important tips when using a debt consolidation loan calculator is to ensure you are entering accurate information. Double-check the balances, interest rates, and minimum payments for each of your debts to avoid inaccurate results. The more precise your data, the more reliable the calculator's estimates will be. Another helpful tip is to experiment with different loan terms and interest rates to see how they impact your monthly payments and the total cost of the loan. Try adjusting the loan term to see how it affects your monthly payment. A longer loan term will result in lower monthly payments but a higher total cost due to accrued interest. A shorter loan term will result in higher monthly payments but a lower total cost. Also, try different interest rates to see how they impact your monthly payments and the total cost of the loan. Even a small difference in the interest rate can have a significant impact over the life of the loan. Don't just focus on the monthly payment. While a lower monthly payment may seem appealing, it's important to consider the total cost of the loan, including interest and fees. A loan with a slightly higher monthly payment but a lower overall cost may be a better option in the long run. Compare offers from multiple lenders to find the best possible deal. Different lenders may offer different interest rates, fees, and loan terms.

Potential Drawbacks

While debt consolidation can be a helpful strategy, it's important to be aware of the potential drawbacks. One potential drawback is that you may end up paying more interest over the life of the loan if you extend the repayment term. While debt consolidation can lower your monthly payments, it may also take you longer to pay off your debt, resulting in more accrued interest. Another potential drawback is that you may need to offer collateral to secure the loan. If you fail to make your payments, the lender may be able to seize your collateral, such as your home or car. It's essential to carefully consider the risks and benefits before you pledge any assets as collateral. Additionally, debt consolidation may not address the underlying causes of your debt. If you don't change your spending habits, you may find yourself accumulating debt again in the future. It's essential to create a budget, track your expenses, and identify areas where you can cut back. Be sure to check fees. Some lenders may charge origination fees, prepayment penalties, or other hidden costs. Be sure to carefully review the terms and conditions of the loan before you sign anything. In some cases, debt consolidation may negatively impact your credit score. If you close multiple credit card accounts as part of the debt consolidation process, it could lower your credit score, especially if you have a long credit history with those accounts.

Fun Facts

Did you know that the average American household has over $5,000 in credit card debt? That's a significant amount of debt to manage! Another fun fact is that debt consolidation loans are becoming increasingly popular as more people seek ways to simplify their finances and reduce their debt burden. In fact, the debt consolidation loan market is expected to grow significantly in the coming years. Here's another interesting tidbit: some debt consolidation loans are unsecured, meaning you don't have to put up any collateral to secure the loan. These loans are typically based on your credit score and income. On the other hand, secured debt consolidation loans require you to offer collateral, such as your home or car. These loans may offer lower interest rates, but they also come with the risk of losing your collateral if you fail to make your payments. Using a debt consolidation loan calculator can save you time and effort by quickly comparing different loan options and estimating your potential savings. It eliminates the need to manually calculate the costs and benefits of each loan. Also, remember that you can use the calculator as many times as you need to explore different scenarios and find the best loan for your situation.

How to Debt Consolidation Loan Calculator

Using a debt consolidation loan calculator is a straightforward process. First, gather all of your debt information, including balances, interest rates, and minimum payments. Then, find a reputable online debt consolidation loan calculator. There are many free calculators available online, so be sure to choose one from a trusted source. Next, input your debt information into the calculator. The calculator will typically ask for the following information: the total amount of your current debt, the interest rates you are currently paying on each debt, and the potential interest rate and term of a new debt consolidation loan. Once you've entered all of the required information, the calculator will generate a report showing your estimated monthly payment and the total amount you would pay over the life of the loan. You can then experiment with different loan terms and interest rates to see how they impact your monthly payments and the total cost of the loan. Compare the results from different loan options to find the best fit for your budget and financial goals. Finally, remember to double-check the accuracy of your data before making any decisions. The more precise your data, the more reliable the calculator's estimates will be.

What if

What if you find that a debt consolidation loan calculator shows that debt consolidation is not the right option for you? Don't despair! There are other strategies you can use to manage your debt. One option is to create a budget and track your expenses to identify areas where you can cut back. Even small changes in your spending habits can make a big difference over time. Another option is to negotiate with your creditors to lower your interest rates or set up a payment plan. Many creditors are willing to work with you if you're struggling to make your payments. You can also consider a debt management plan through a credit counseling agency. A credit counselor can help you create a budget, negotiate with your creditors, and develop a plan to pay off your debt. What if you find that you're unable to qualify for a debt consolidation loan due to a low credit score? Focus on improving your credit score by paying your bills on time, reducing your credit utilization, and avoiding new debt. As your credit score improves, you'll have access to more loan options and better interest rates. Remember that managing debt is a marathon, not a sprint. It takes time, effort, and discipline to pay off debt and achieve financial freedom.

Listicle of Debt Consolidation Loan Calculator

Here's a listicle to guide you through debt consolidation loan calculator:

- Gather Your Debt Information: Collect details on all debts including balances, interest rates, and minimum payments.

- Find a Reputable Calculator: Use online debt consolidation loan calculators from trusted sources.

- Input Accurate Data: Enter your debt information precisely into the calculator.

- Compare Loan Options: Evaluate different loan terms, interest rates, and monthly payments.

- Consider Total Cost: Look beyond monthly payments to the overall cost of the loan.

- Check Your Credit Score: Aim for a better credit score for more favorable loan terms.

- Shop Around for Rates: Compare offers from multiple lenders to find the best deal.

- Address Underlying Issues: Manage spending habits to prevent future debt.

- Watch for Hidden Fees: Be aware of origination fees, prepayment penalties, and other costs.

- Know Drawbacks: Understand potential drawbacks like longer repayment terms and collateral risks.

Question and Answer

Q: What is a debt consolidation loan calculator?

A: It's a tool that helps you estimate your monthly payments and total costs when combining multiple debts into a single loan.

Q: How does a debt consolidation loan calculator work?

A: You enter your current debt information (balances, interest rates) and potential loan terms (interest rate, loan length), and the calculator estimates your new monthly payment and total repayment.

Q: What are the benefits of using a debt consolidation loan calculator?

A: It allows you to compare different loan options, understand the impact on your budget, and make an informed decision about whether debt consolidation is right for you.

Q: What information do I need to use a debt consolidation loan calculator?

A: You'll need to gather information on all of your current debts, including balances, interest rates, and minimum payments. You'll also need to have an idea of the interest rate and loan term you might qualify for on a debt consolidation loan.

Conclusion of Debt Consolidation Loan Calculator: Compare Options

In conclusion, understanding debt consolidation and utilizing a loan calculator are crucial steps towards taking control of your finances. By comparing options and carefully considering the potential benefits and drawbacks, you can make informed decisions that align with your financial goals. Whether you're seeking to simplify your payments, lower your interest rates, or create a more manageable debt repayment plan, the knowledge and tools provided in this article can empower you to achieve financial freedom. Remember to focus on responsible spending habits and continuous financial education for long-term success.

Post a Comment